Common Denial Types and Pain Points

In the first part of this three-part denial management blog series, we will be focusing on common medical billing denial types and pain points. In this series, we hope to provide insight into all of the costs that are associated with denied claims—some of them may surprise you.

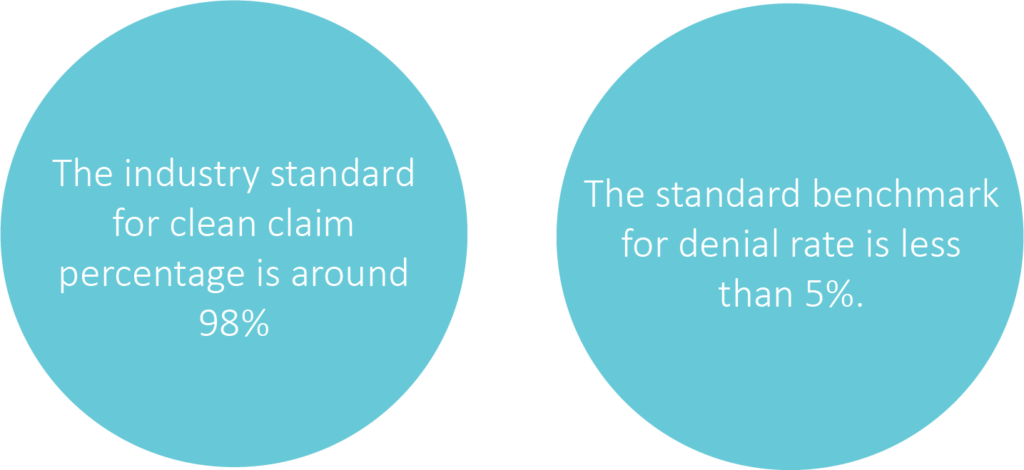

Industry Statistics

Since the beginning of the pandemic, industry numbers are showing an increase in denial rates.

Lack of needed resources due to having to lay-off staff or shift job responsibilities are one of the causes of the increase. Department experience, such as insurance verification, authorizations and billing staff directly affect how claims are processed.

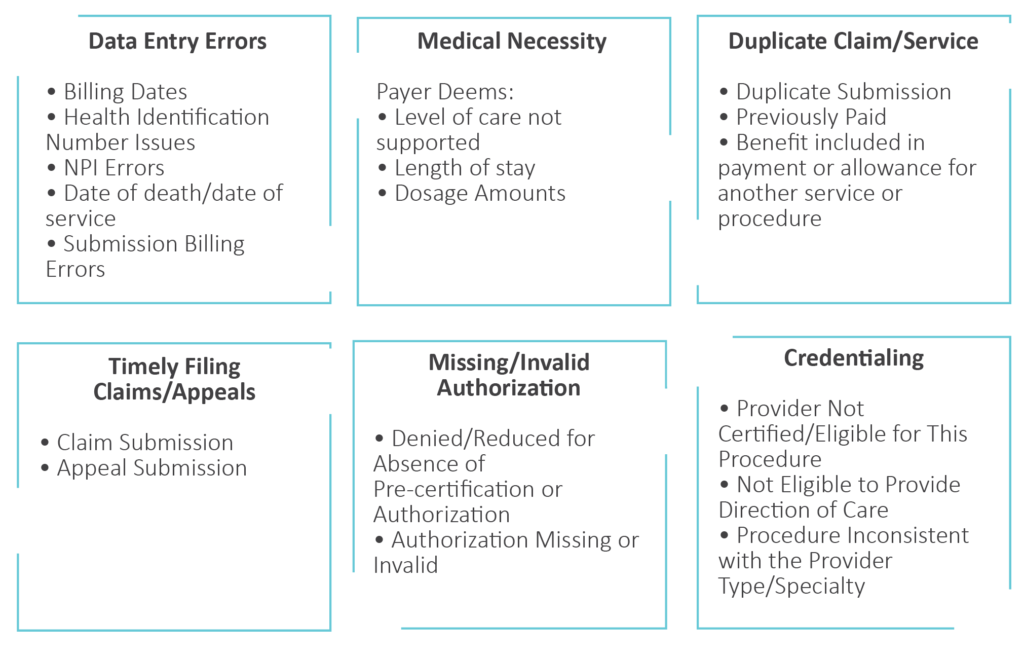

Common Medical Billing Denial Types

Common Denial Pain Points

There is no question that denials are a pain—lets take a look at some of the most common pain points:

Ability to Keep Up with Payer Contracts

Who is responsible for maintaining the payer contracts? Is there a designated party that will track updates and ensure information is properly disseminated to staff? Keeping up to date with payer contracts can increase a hospital’s clean claim rate and give them solid ground for appealing claim denials.

Lack of Knowledge/Expertise

It is not uncommon to hear that in-house knowledge and/or expertise in resolving denials is lacking.

In a recent survey we performed, we had providers rank their greatest denial struggles from least amount of concern to greatest. The providers surveyed indicated that lack of knowledge/expertise to work their denials was one of their greatest concerns.

Lack of Resources for Denial Follow-Up

You might have the knowledge and expertise piece covered in-house, but could still lack the resources to complete the work. Staff with the knowledge may be allocated to other departments and be non-existent within your designated denial team.

Payer Communications

Who is calling the insurance companies for follow-up? Payers don’t always make it easy to reach the appropriate person for claim resolution—it’s not uncommon to be given the run-around.

Inadequate or Non-Existent Internal Processes

In some cases, you might just not know where to start or how to put the pieces together to achieve the desired outcome.

Loss of Revenue and Unnecessary Write-Offs

This is perhaps the biggest pain point of all—no one wants to see money go down the drain.

What are you losing in denial dollars? These are dollars that may have been recovered if the appropriate resources and knowledge was utilized.

Perhaps the resources were there, but the failed appeal attempts prevailed. Many times, hospitals will write-off balances because they know they do not have the resources available and keeping the dollars open on accounts receivable is not an option.

To figure out what dollars are being written off, first calculate the net denial dollars and divide them by the average patient service revenue.

This calculation is useful in determining if the loss is great enough to bring in additional resources.