Avoidable/Unavoidable, Prevention and Cost Analysis

This is part two in a three-part denial management series, “The Real Cost of Denials”.

In Part One, we reviewed common medical billing denial types and the pain points associated with them. Part two will focus on front-end denials, prevention and how to get started performing a denial cost analysis.

Avoidable vs Unavoidable

A denial is considered avoidable if it could have been prevented on the front end. Avoidable denials may happen during registration and insurance verification—it’s possible that an authorization was not obtained when needed.

To prevent avoidable denials from happening, hospitals should provide education, training and/or allocate appropriate staff in departments for the knowledge level needed.

There are also times that a denial is unavoidable, or not foreseen. Lets say that the provider has the right staff and knowledge from registration for clean claim submission, however the claim still denies.

Payer/member contract updates that are not pushed out correctly can cause unavoidable denials. Insurance companies do deny claims erroneously. Providers are not responsible for these claim denials—the insurance companies are.

In most situations, this happens with batch claim submissions due to an automated process in the claim adjudication system. Once the error is fixed, the claims usually reprocess on their own.

Preventing Front-End Denials

Sure, appealing denied claims and recovering revenue on the back end is one way to go about denial management, however in a perfect world, the claims wouldn’t be denied in the first place.

Root Cause

The first step in preventing denials is to determine what is causing them and where they originate from, or the root cause. This is also what we like to call the birth of the denial.

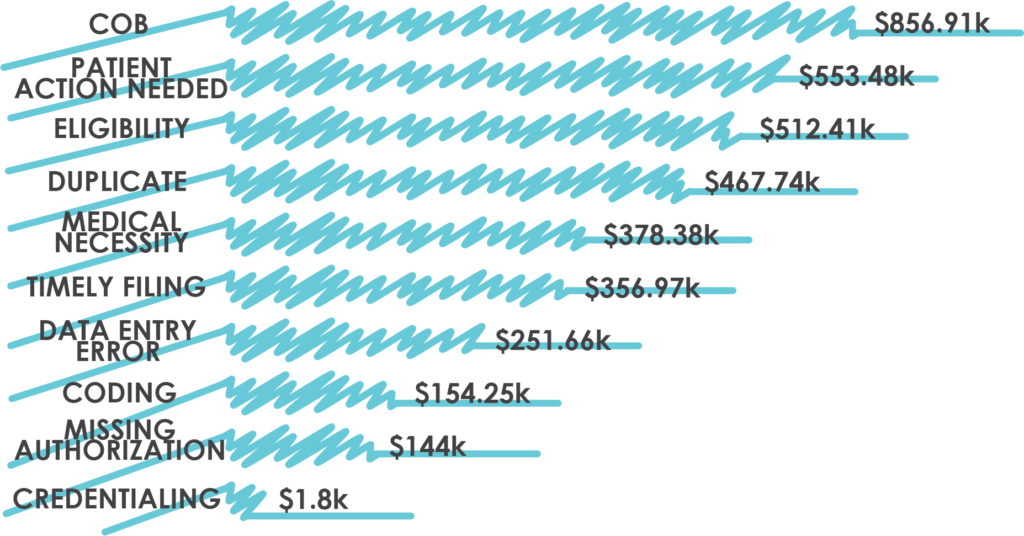

Some of the more common origins include errors during registration/admission, coding and billing.

Service Department

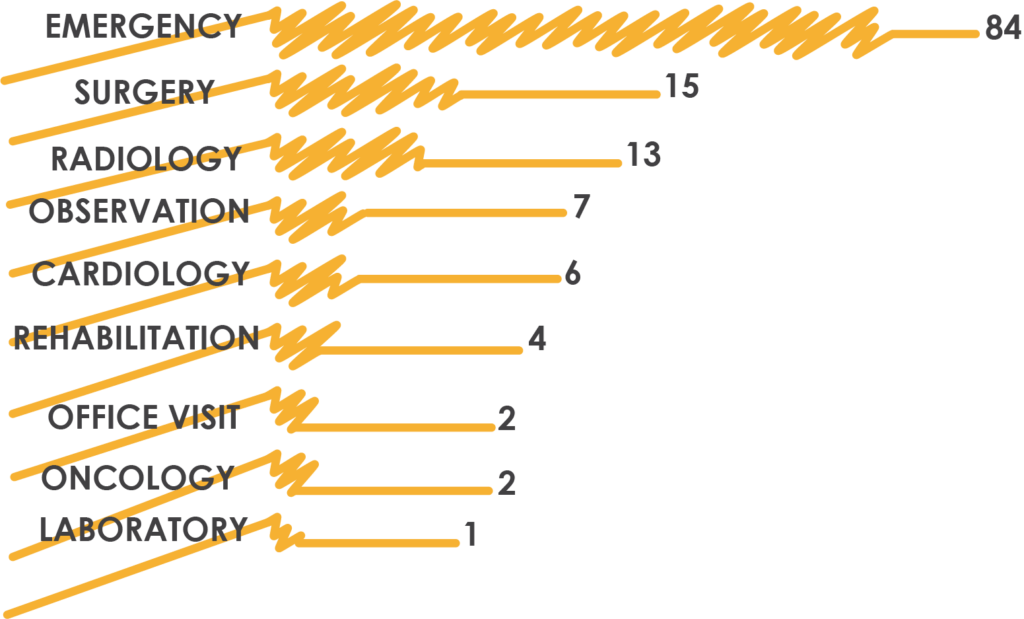

Narrowing denials to the service department allows you to see where process improvement is needed and could indicate a needed change in staff allocation.

Data Analytics

Tracking these details is key, and can be done with a quality reporting process and careful analytics. Having quality analytics can help you answer the question of whether or not you have the right resources in place to prevent denials down the line.

How Much Are Denials Costing You?

Unfortunately, there is no magic number that answers that question—which is just one of the reasons that denials are such a hot topic.

Denial costs are variable and are dependent on a number of factors, including facility, structure and internal process, volumes and payer types. Many of these factors fluctuate constantly.

Instead of latching on to a one-time figure, we recommend using a few different metrics and regular analysis—more of a living indicator.

It is likely that there is some data analysis already happening within your EHR—oftentimes, we find that this analysis is neither as robust nor as detailed as a facility needs it to be. Utilizing business intelligence products can be very helpful in tracking and monitoring data when it comes to denials and the associated costs.

Take a look at the some the basic building blocks we recommend you use to begin your denial cost analysis:

Defining Values

Defining values is crucial in the beginning of a denial cost project to ensure that all team members are aggregating data points and executing calculations in the same way.

Birth Date

How do you start counting for day one at your hospital—at the date stamped on the 835 or once your EHR processes the R.A. and distributes it into your work queues?

Depending on your facility’s internal processes, there could be a variance of 1-2 days between these two options.

Death of a Denial

When do you call it done? Ideally, the end point would include a payment.

When calculating payment from a payer, be sure to use the contractually negotiated amount and not the total charges—not doing this will result in false negatives showing for payments due.

When the payment is the patient’s responsibility—due to either un-covered charges or patient-payer requirements that need to be met—the death of the denial can come once the agreed upon total is paid.

Unfortunately, these accounts sometimes go to collections. This means you not only need to define the amount the patient owes, but also consider your collection agency’s fees when calculating costs. Contingency fees can range up to 40% of the total collection, sometimes in addition to a flat fee.

You can start to see why calculating the cost of a denial is tricky.

“Hospitals are writing off 90% more denials as uncollectable compared to six years ago.”

REVCYCLE INTELLIGENCE | Hospitals Write Off 90% More Claim Denials, Costing Up to $3.5M

Another possible death of a denial option is a write-off. Writing off denials may seem more appealing—especially when looking at managing A/R days—however that option leads to an increased write-off balance and less revenue for your hospitals.

The final option for death of a denial is charity care. With this option comes an application process and the need for patient involvement, which can be time consuming. You’ll also need to determine the value associated with the charity care applied to the denial cost.

Look for Part Three: Calculating Denial Cost coming soon!