Calculating Denial Cost

This is part three in a three-part denial management series, “The Real Cost of Denials.”

Now that we have solidified the definitions, we can move to calculating costs.

Denial Rates and Averages

Divide denial dollars by total charges submitted. Don’t forget to use the contractually negotiated charges we talked about in part two!

A lower rate suggests a healthier cash flow—and may allow for leaner staffing, which is a cost factor associated to your denial population.

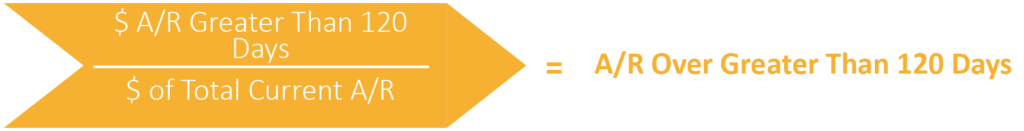

A/R Over 120 Days

To determine A/R greater than 120 days, divide the dollar amount of A/R that is greater than 120 days by the dollar amount of the total current A/R.

Denial Result Mix

Monitoring denial result mix can suggest how effective your efforts are—you are then able to apply volumes to the specific cost of the results to provide clarity on denial costs.

Denial Age

Time is money—strive to keep cash flow strong. Monitoring denial age is an important part of the process when tracking denial cost.

Denials to Collections

Monitoring the volume of denials being sent to collections provides an indicator of denial cost. As previously mentioned, costs will vary depending on your facility’s collection process and associated fees.

Our suggestion here is to compare the cost of collection to the cost of submitting secondary/tertiary denial appeals. Both of these actions come with their own price tag—the ROI of each should be evaluated.

Once you have made it to this point, you can break the data down further to evaluate location, cause, payer and reason.