Medical billing is overwhelming and complex for patients. According to a recent public opinion survey, 72% of consumers are confused by their medical bills. The typical medical bill consists of multiple sections complete with codes, descriptions and prices that don’t usually make a whole lot of sense to the general public.

Even those of us that work in the healthcare industry don’t always have a great handle on how to deal with and validate the bills we receive–how can you tell if you were billed correctly? Did your insurance pay what it was supposed to? Did it pay anything at all? What services were you billed for? How long do you have to pay your bill?

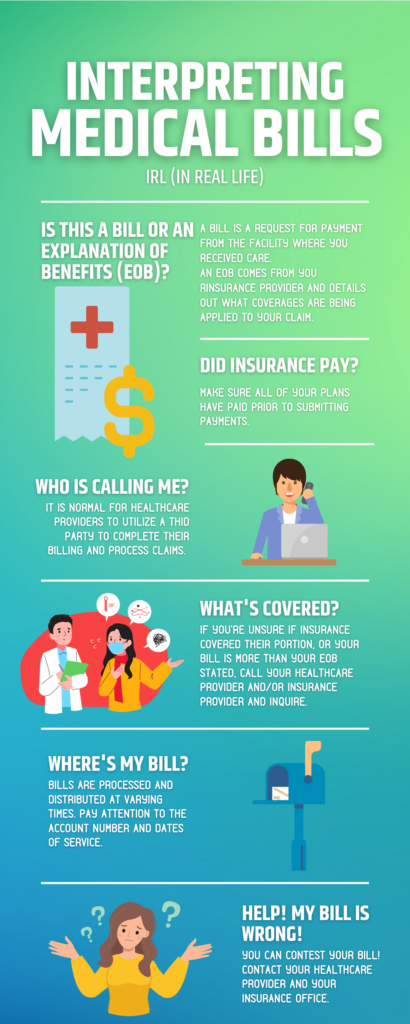

Is This A Bill?

Let’s start with making sure the document you received is indeed a medical bill that requires payment.

Sometimes people get confused on whether they’ve received a bill or an Explanation of Benefits (EOB).

A bill is a request for payment from the facility you received care at. A bill will contain a statement date, account number, date of service, description, charges, billed charges, adjustments, insurance payments, patient payments, balance/amount due, and payment instructions.

An EOB comes from your insurance provider and details out what coverages are being applied to the “claim” the hospital sent them to cover the charges for your care. An EOB will typically be sent to you prior to a bill and may indicate the amount you will be expected to pay.

An EOB will contain your health insurance member information, patient account number, provider name, claim number, date of service, service code, total amount/cost of the procedure(s), services and corresponding dollar amount not covered with reason code description, deductibles and copayments, total net payment, total patient responsibility and payments issued by your insurer to your healthcare provider.

An EOB is not a bill.

Did My Insurance Pay?

A quick check of your bill should show a line item indicating insurance payments that were made and which insurer they were made by.

If you have multiple types of insurance coverage–whether it be private commercial insurance, Medicaid and/or Medicare–make sure all of your plans have paid prior to submitting any payments.

If you don’t see all of your insurers showing a payment, reach out to your healthcare provider ensure they are aware of all of the types of coverage you have.

It’s important that all of your coverages are presented to ensure that your provider receives proper reimbursement, avoid claim denials and to reduce your overall out-of-pocket expense.

The order in which claims are submitted to the payers is critical for these things as well. For example, if your provider is only presented with one of your coverages–and it’s not your primary coverage–they will receive a claim denial indicating another payer is primary.

If they don’t have the information for which of your coverages is primary, the full responsibility of the claim will be billed to you until the correct information has been returned to them.

Who is Calling Me About My Bill? How Did They Get My Information?

Your healthcare provider may utilize a third party to complete their billing and process claims. If you receive mail or phone calls from a company you don’t recognize looking to speak with you about your bill, call your healthcare facility directly and inquire. They’ll be able to confirm if these outreach attempts are from a trusted source and not scams.

How Will I Know What Services My Insurance Covered?

If you are unsure if insurance has covered their portion accurately, or your bill is for more than your EOB states was the expected responsibility, don’t pay on the first notice!

Don’t panic–you won’t be sent to collections right away. Call your healthcare provider and/or insurance provider and inquire about the discrepancy before submitting any payments.

It’s important to compare your EOBs and your bills to ensure the charges match.

When Will I Receive My Bill and How Should I Pay It?

If paying by check, make sure you write the corresponding account number in the memo line of your check–this will help track your payment to ensure it’s applied to the appropriate services. You may have multiple accounts open at any given facility.

Bills are processed and distributed at varying times since your visit. Again, it’s important to pay attention to the account number and dates of service (DOS)–if you’re unsure which visits and services your bill is for, compare the account number to the correlating account in your patient portal.

Remember–you can always request a copy of your medical records (this requires a signed release form).

What Am I Being Billed For?

It’s not uncommon to review a bill and see a term you might not recognize.

If you don’t understand what you’re being billed for, call your healthcare facility and request an itemized bill. This will break down each charge that is being applied to your bill.

Make sure the line items reflect the care you received accurately–again, you can always request a copy of your medical records to verify.

What Do I Do If My Bill is Wrong?

The billing cycle is complex and mistakes happen.

Some common errors include:

- Inaccurate code entry

- Typographical errors at various points in the process, including misspelling your name or other demographic information. It’s especially important to make sure your name and identification numbers are correct to ensure there are no coverage discrepancies.

- The wrong plan information was applied

- Duplicate charges

If you determine there are errors, don’t panic–you can contest your bill! During this process, be sure to ask for call reference numbers (if available), and the names of the people you speak with–keep a time stamped running list. This process will likely involve speaking to representatives from your insurance company as well as your healthcare provider’s billing office.

Some estimates state that upwards of 80% of medical bills contain errors.

If something doesn’t seem right, ask!

Rachel Harris, RHIA, CPAR

Rachel’s background is in Health Information Management–she has spent the past 10 years involved in everything hands-on patient care to software development. She has extensive work experience with the revenue cycle and HIM functions; including coding, claim scrubbing, denials, physician training, transcription and dictation, records creation and retention, credentialing processes, portal development, coordination of departments and mentoring interns.

She currently serves as the Treasurer for MN AAHAM Gopher Chapter.